Want to become a financial coach in 2023?

Running your own coaching business comes with many perks, such as freedom, flexibility, and purpose.

But how do you make it happen? In this post, you’ll learn…

- What financial coaching is

- How YOU can start a financial coaching business (even if you’re currently in a busy 9-5)

- How to get your first paying clients

- What it takes to grow it into a full-time business

Want to learn more? Read on!

Chapters:

What is financial coaching?

Should YOU become a financial coach?

How to build a profitable financial coaching business and quit your 9-5

How to grow your business to 6- and 7-figures

Want to Build a 6-Figure Coaching Business So You Can Achieve More Freedom?

When you sign up, you’ll also receive regular updates on building a successful online business.

What is financial coaching?

As a financial coach, you help people improve their financial habits and achieve their money goals. And the need for financial coaching is at an all-time high.

After all, 35% of Americans with a credit file have debt in collections. Only 46% have a rainy day fund. And 24% of millennials demonstrate basic financial literacy. And so on.

At the same time, 25% of Americans say they stress about money all the time. Money is seen as more stressful than relationships and work.

But what exactly can you help your clients with? And what are the benefits of a financial coaching business?

What are the benefits of becoming a financial coach?

Financial coaches help their clients improve the way they handle and earn their money. For example, coaches can help coachees to:

- Get out of debt. You support people to pay off their debt in a smart way and make smarter money decisions.

- Organize their finances. You help people understand how to use and manage their money better.

- Save money. Together with your coachee, you set up saving plans and goals.

- Make more money. This can be more generally about getting raises and finding new income streams or something specific, like creating an extra income stream with real estate investments.

- Adopt better money habits and change their money beliefs. People have different beliefs about money and as a money mindset coach, you help them transform those blocking beliefs.

For example:

According to a study that was part of the 2013 initiative by Citi Foundation and NeighborWorks America, financial coaching has tangible results.

More than half of clients who hadn’t had ANY savings at the start of their coaching reported some savings after participating in the program.

Also, participants increased their FICO scores by an average of 59 points.

And two-thirds of those who had felt stressed about their financials when the program began didn’t feel that way after going through coaching.

A 2015 study by the Urban Institue shows even clearer benefits.

Participants achieved significantly higher credit scores thanks to coaching.

And depending on which group they were assigned, they accumulated $1,200 in savings and debt declined by $10,650.

That’s how powerful financial coaching can be — it can actually change your clients’ lives.

How do you set up your services?

The best way to start helping your clients? Privately, through one-on-one coaching sessions. Later, you can create group programs and online courses to scale your business.

As you can see, financial coaches can have a huge impact on people’s lives.

So, a coaching business comes with the potential to have a positive impact. What else?

Well, the first obvious reason is this: You can replace your salary and quit your 9-5.

You get to work for yourself. That means: No boss who tells you what to do, you yourself decide when and where you work.

You get to choose your clients. The format you use to coach people. And so on.

You pretty much get to choose what your work and life looks like.

What’s possible with your business?

How do I know all this? Because before I started my business, I was where you are now. At a demanding 9-5 that felt like it lacked any purpose. I couldn’t decide my own hours and was stuck with the vacation days my employer allowed me to take.

That’s why online coaching felt like SUCH a great option. I realized that I could start my own business while working my 9-5 and quickly make a great income.

And within four months, I had quit my day job and had already made 6-figures in my business (at the time, a Facebook ads coaching business).

Today, I’ve helped tons of clients do the same (among them several financial coaches). You can read all about it here.

How much does a financial coach make?

Curious to know what the earning potential of a financial coach is?

Look, here’s the thing:

As a coach (and business owner), you decide how much you make. That’s one of the great perks of this line of work.

Plus, as a financial coach, you can easily show tangible results (for example, money saved or made or debt paid off). That means it’s even easier to get people to happily open up their wallets.

So to clarify:

There’s no income cap.

Of course, you have to start somewhere before you’ve built up enough momentum to get people to see your value.

My recommendation is that you start selling 3-month financial coaching packages at $1,500. That’s a low-barrier commitment for your clients and you get to practice your skills as a coach.

Now, you might be thinking, “All this sounds great, Luisa… But can I really justify charging people who have financial problems?”

Let me clarify something:

This is NOT about you taking money away from them. It’s about you helping them get out of debt.

People WANT help with their problems. And they are smart. (At least the kind of people you want to work with are.)

If you can show that you help get your clients results (with your own results or someone you’ve helped) and that you have a solid background in managing money, you can help your clients get results.

And in that case, it’s an investment, not a cost for your clients.

(Imagine them NOT getting your help. Where will they be 5-10 years from now?)

Ultimately, as a coach, you are in charge of who you work with. If you don’t feel like someone will get out of debt when you first talk to them or you feel, for any other reason, that you shouldn’t work with this person, you don’t have any obligation to accept them as your client. (And instead, work with one of those thousands of people out there who are a much better fit.)

Want to Build a 6-Figure Coaching Business So You Can Achieve More Freedom?

When you sign up, you’ll also receive regular updates on building a successful online business.

Should YOU become a financial coach?

Not sure that you have what it takes to become a money coach? No worries. This chapter will show you if you should (or shouldn’t) start building your own financial coaching business.

First things first:

Are you qualified to become a financial coach?

Look:

There’s an easy “test” you can take here. Think back at your skills and experience. Then ask yourself, have you helped someone manage their money and achieve great results? Or yourself? Or do you have professional experience in money management?

Either way: If you have results to show, your specific type of experience doesn’t really matter. That’s because, with your results, you can show that you can help others get results, too. And that means you’re qualified to become a financial coach.

(You might be thinking, “I have the skills, but not the results. Does that mean I can’t be a coach?” If that’s the case, there’s a simple solution. Go out there and help people, your friends or family. With their results, you’ll quickly show your value to clients.)

Examples of financial coaching businesses

Want a couple of real-life examples of people who’re running their financial coaching businesses?

Here you go:

My client Lucy Moy left her six-figure job to spend more time with her family thanks to having built up a real estate portfolio that generates around $10K/month. Now she helps others build up their own real estate portfolios as a real estate coach.

Ryan Chaw helps people make smart real estate investments with his specific real estate investment strategy. Ryan created $10k+ in passive monthly income by investing in single-family home real estate.

And to give you an example of how a coach can help their clients turn around their financial life:

My client Jacquelynn Peterson is a mindset coach. She changed her money mindset to get a 6-figure salary at her corporate job and get out of $150K+ in debt. Even if Jacquelynn doesn’t specialize in helping people improve their money mindset, she’s a good example of how coaches can use their experience to help their clients get great results.

Do you need a financial coaching certification?

You know, one of the biggest myths in the coaching industry is this:

To become a coach, you need a coaching certification.

Not. True.

Yes, in some VERY specific cases, you’re actually required to get a degree or certification. Those are exceptions.

In most cases, you don’t need a certification. That’s a way for coaching certification companies to make more money.

Instead, you can set up shop, start working with clients (at a much lower rate than the rate you’ll ultimately aim for) and get results.

That way, you offer your financial coach services for a lower rate, improve your skills, become an incredibly good coach, and start charging more.

No certification needed.

Also, there’s an important distinction that needs to be made here.

A financial coach is not a financial advisor (who usually have completely different requirements for their services). As a coach, you offer support and guidance, you don’t sell and recommend financial tools. You also don’t manage the coachee’s financial portfolio for them.

And as a financial coach, what ultimately matters are your results.

Now you know if you should become a financial coach. Next up: What it takes to build a profitable financial coaching business.

How to build a profitable financial coaching business and quit your 9-5

How do you build a massively profitable business that you love?

The steps to do that aren’t complicated:

#1: Share your solution to a problem that people want solved.

#2: Lead with value (aka epic free content).

#3: Share it with as many people as possible.

Repeat.

Now, there’s a difference between STRATEGY and TACTICS.

That means that yes, technology will change and the tactics you use will have to be updated accordingly. (For example: Which social media platform works best for getting clients?)

But the STRATEGY doesn’t change.

Even though I’ve changed and added on different tactics to my business over the years, my strategy has always been the same.

With the right strategy, I got my first paying client. I built one of the top businesses in my industry. And I became known for the best content, both free and paid.

And it’s thanks to the strategy that so many of my students have built their own profitable businesses from scratch (here it is in even more detail).

Get your first paying clients

But what’s strategy you should use to get your first few clients? Simple.

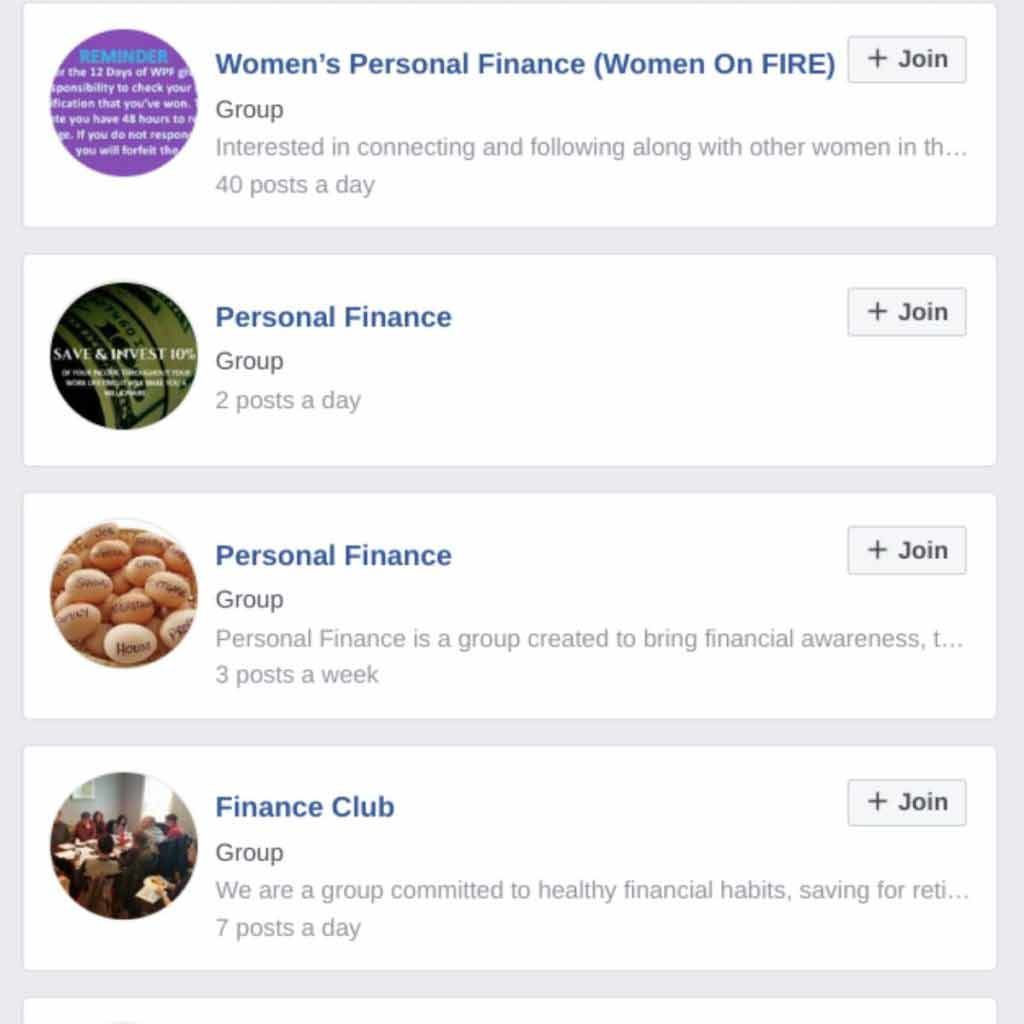

Step #1: Go to a platform where your clients hang out.

This could be Facebook groups, Instagram, LinkedIn, YouTube or some other platform.

Focus on one or two platforms. In terms of Facebook groups, I recommend that you join 3-5 groups (that way, you see which groups work best and can focus on those).

Step #2: Give, give, give.

On your chosen platform, start engaging and sharing content that solves people’s questions about their finances.

This is key: Your content HAS to be incredibly valuable. Focus on giving instead of ‘selling’ or ‘marketing.’

And with “value,” I don’t mean boring.

Instead, think of why people are on these platforms:

To get entertained.

That’s what your content should do, too (and then in that content, you include your golden nuggets).

Step #3: Get on a free 15-minute call.

Once you’ve shared valuable content for a while, it’s time to start selling.

And NO, selling does not mean salesy.

If you were salesy, you would be spamming social media with annoying sales messages.

It’s the kind of stuff that business-coaches-who-shouldn’t-be-business-coaches will tell you to do. It’s not how it works.

Instead, build some trust in an authentic way by offering a free 15-minute coaching call. During this call, you offer a valuable insight about how your coachee can manage her finances.

Your call should be related to your coaching offer. For example: if you help people save more money, you share a simple tip on how to start saving more money by the end of the month.

And at the end of that call, offer your services. You can say something like:

“Now that you’ve seen how much value you got in just 15 minutes, would you like to talk more about how we can work together to make this happen for you?”

This way, you share incredible value with people who immediately see for themselves how much you can help them.

Want to Build a 6-Figure Coaching Business So You Can Achieve More Freedom?

When you sign up, you’ll also receive regular updates on building a successful online business.

How to make sure you get it all done as fast as possible

If you’re wondering what will grow your business fast, it’s this: Being consistent.

Show up every day, share your content, and get people on calls. That’s it. That’s the “magic” formula for growing your business.

Because the thing is:

Your business is a business, not a hobby. So treat it that way!

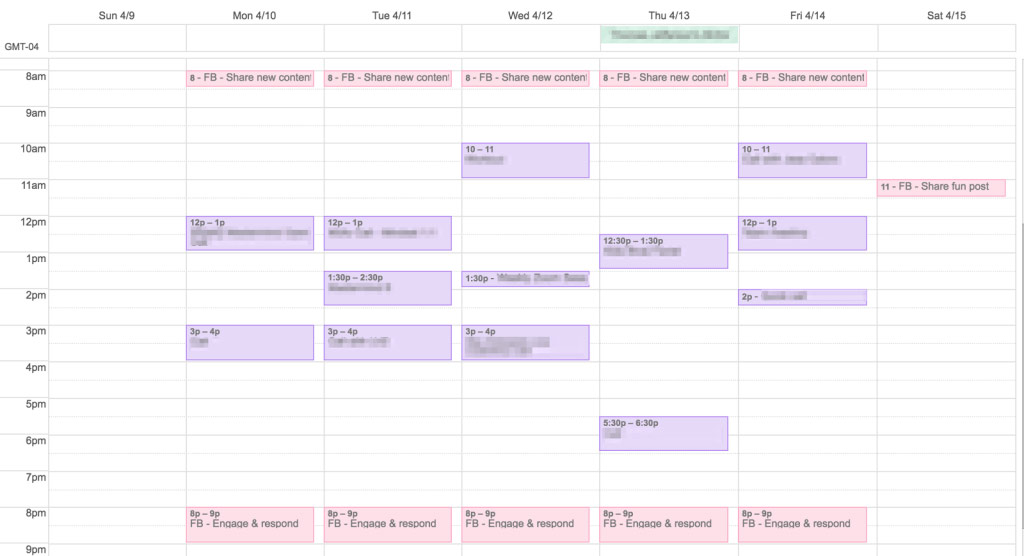

And if you’re wondering HOW to do this while you’re trying to manage your life and schedule, good news. I have a calendar-management hack for you.

You see, when I was growing my own coaching business, I was simultaneously managing my busy corporate job.

The way I made sure I was consistently working on my coaching business was this:

I scheduled EVERYTHING.

Every day, I would set aside 3 x 15-minute blocks throughout the day. I used these blocks to engage in Facebook groups and share my content.

That way, I had already committed to working on my business and it made it a no-brainer for me to get my tasks done.

This ultimately helped me grow my business to 6-figures in 4 months. That’s when I decided to quit my job and build my coaching business full-time.

You don’t necessarily need a 6-figure business to quit your job. I recommend my clients to double their salaries (so that they can pay for their expenses and taxes).

What NOT to focus on

Listen:

It’s easy to get stuck in thinking about ALL the tactics you need to grow your business. But when you’re just starting out, you DON’T need that much in your business.

The things you shouldn’t waste your time on right now are a coaching website, a marketing funnel, or webinar funnels.

And a big no-no: Don’t outsource your business. If you try to get others to create your content (that we talked about above) or think you can have someone else do your sales calls… Don’t do it.

New coaches who pay have their marketing done for them at this stage (because it’s “easier”) will quickly realize in the long-term they have no clue how to market to their clients. (And are a few thousand dollars poorer with a funnel that 99.999999% of the time does not work.)

It’s WAY simpler than that to start a financial coaching business.

The steps I share above are literally all you need to do right now. When you have your first clients, you can start thinking about things like website, Facebook ads, and emails.

How do I know? Because I know, for a fact, that I wouldn’t have been able to grow my own business so fast without these steps.

Financial coaching tools

What financial coaching tools do you need to get your first paying clients?

Again, don’t go crazy here. You need a couple of tools to set up your coaching calls and get paid.

These are:

Calendly – Use this scheduling tool to schedule your free coaching calls and coaching sessions.

Zoom or Skype – You need to be able to call your clients and to do sales calls. These video calling tools will help you do just that.

PayPal or Stripe – PayPal or Stripe work great as payment tools.

These are the ONLY tools you need for now.

How to grow your business to 6 and 7-figures

Your first task is to get your first paying clients. Focus on that before you do anything else.

But when you’ve started making money in your business? (Rule of thumb: You’re making $5-10K/month or however much you need to replace your income.)

That’s when you can start thinking about how to grow your financial coaching business.

Because listen:

There’s SO much opportunity to build a profitable business you love.

When you have your coaching business up and running, you can either continue growing the coaching side of your business and eventually hire coaches to help you out.

Or you can start selling online courses. This is a way to scale your business faster because you don’t have to deliver personal coaching services anymore.

With your courses, you can basically deliver the same value as in your coaching program but to a much bigger group of people.

This is when you’re starting to think of things like:

- Facebook ads.

- Webinars.

- Email funnels.

- Expanding your marketing to different channels.

By reaching more people, you get more leads into your sales funnel and ultimately, you grow your business. That’s the strategy I used for ultimately scaling my business to $1 million in a year.

Want to start your own financial coaching business?

Now you know what it takes to become a financial coach.

With the right strategies (which I share above), you can quickly set up your coaching business and take the first steps to replace your income with a flexible coaching income.

I’d love to hear from you:

What type of financial coaching business are you planning on starting?

Leave a quick comment here below. (I read all of them!)

Want to Build a 6-Figure Coaching Business So You Can Achieve More Freedom?

When you sign up, you’ll also receive regular updates on building a successful online business.

15 Responses

Financial coaching is an essential service. I think that many people can benefit from this in this time of crisis. I just don’t know how many will be willing to pay for it.

Don’t get stuck in not knowing – take action and do some research to find out! (This is an established market.)

I want to help people like me. Who grew up with the utilities being turned off, because they were never taught about money management. The average Joe. I want to help them be more hopeful, confident, and happy with thier finances like I have been able to do personally.

That’s beautiful! Definitely needed.

Thank you Luisa for this amazing content. Money management is today the key to freedom. It is great that we have someone that helps us to help others.

Hadja Fatou

Thank you Hadja!

I have listened to Dave Ramsey over the years but have found that his way does not appeal to most people. Most want to find ways to save money, pay bills efficiently and establish credit as well as being able to live the American dream and own a house. I have had issues with all of these items and have overcome all of them. I’ve gone from a 500 credit score after a divorce to a 780 score currently wit some effort and discipline on my part. This is exactly how I want to help people attain some financial freedom without having to pay cash for everything like Ramsey boasts.

Sounds like you’ve figured out a great method that works for you – and I’m sure will work for many others too! That’s the foundation for building something amazing that is unique to you and helpful to so many!

I have “pulled myself up by my bootstraps” financially speaking.

I started as a young adult with no money management skills, if I had money in the bank before next pay day it meant I had money to spend on stuff, right? That was my mindset, so saving for anything never occured to me.

Now, through the school of hard knocks, I’ve learned money management and how to play the credit game to my advantage and I want to help teach others how to as well.

That’s wonderful! Money management skills are so needed! But unfortunately, most of us have to learn through the “school of hard knocks.”

I am interested in becoming a financial coach, but not sure where or how to get started. While in school for my degree in accounting, I helped my sister get out of an impossible financial situation that was going to leave her homeless. I helped her manage her own finances, avoid eviction, and taught her the value of placing money in savings all while having little money to survive on. This got me thinking I might be able to help others manage their money in similar situations. Of course, I did not charge my sister for my services, and I am not sure how to turn this into a business.

That’s fantastic that you’ve already helped your sister! I would start with the basics – do some market research (this is an established market), get clear on what you can offer, and start sharing your knowledge + offer – online and with your network.

I’m starting a financial coaching business to empower high-achieving women in their 40s to optimize their finances while improving their financial literacy and creating healthy money habits.

That’s wonderful. Wishing you the best!

This is great content, thank you for sharing! I’m a freelance/contract employee in the film industry and am a real estate agent as well. I would like to add ‘financial coach’ as another one of my pursuits because I see a lot of freelancers struggle in the slow periods (especially now that the film industry is on strike) and not have enough savings built up to weather the storm. I also come across people who really want to buy their first home but aren’t qualified due to low credit scores or not being able to save up enough for a downpayment. Through self-education (reading books, research, listening to podcasts) I’ve learned about investment, saving and money management enough to grow my net worth 20x in the past 7 years, and I feel that I can help others do the same. I don’t want to spread myself too thin by adding another hyphen to my LinkedIn Profile, but this feels like it could be a natural fit for me (and a good way to transition out of freelance work to focus just on financial coaching and real estate within the next 5-10 years). I’m inspired, thank you!